Mobilisation of Savings for the Formation of Capital

by Prerana Balasubramanian|27 Sept 2020

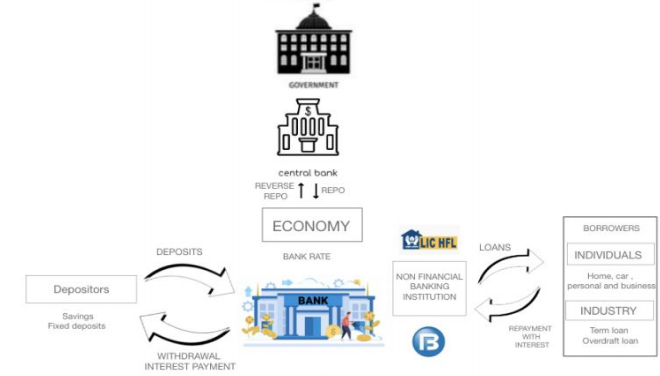

As a child, it is quite fascinating to see how a bank never runs out of money. But the concept of

financial systems and economies around the world is more complex and interconnected than it

seems. The recent pandemic is a great example to see how the fear of coronavirus impacted

the global economy, rocked markets worldwide and plunged stock prices. The lockdown brought

a curb to economic activity and in response to this, the RBI slashes interest rates to counter the

fallout. The flowchart above explains how money circulates in the Indian economy and keeps

economic activity churning.

Money released into the economy comes from the commercial banking system where

individuals and businesses have deposited their money. They are known as the depositors.

The bank pays some money to the depositors depending on the tenure and interest rates. This

helps the depositor make up for the loss in money value over time.

The bank also lends money to individuals and businesses in the form of loans. They are known

as borrowers. The money is used to build offices and buildings, buy raw materials and pay

wages. This contributes to economic growth. A part of the profit made in the business is repaid

to the bank along with the principle.

The bank has money from the depositors and profit from the borrowers. A part of that money

goes towards ATM's and vaults for daily requirement, a part towards depositors interest, a part

towards the bank's expenses and a fixed ratio towards the central bank(cash reserve ratio). The

bank can deposit their surplus funds to the RBI for short periods of time on which they earn a

reverse repurchasing agreement rate(reverse repo). This allows the bank to earn some extra

profits.

The Reserve Bank of India is the guarantor of the banking system as well as the checkpoint of

economic growth. There are several functions of the RBI: It issues bank notes, it manages the

banking needs of the government, it represents the Govt. of India as a member of the IMF and

the World Bank. The surplus funds, after the RBI meets its own expenses, is given to the

government to provide fiscal stimulus to the economy. This could include funding and financing

industries, infrastructure, government debts and enacting various schemes and policies.

At times of financial difficulties faced by commercial banks, the RBI lends these finances at a

reporting agreement rate(repo rate), which is fixed and monitored by them. This helps the RBI

control liquidity, money supply and inflation levels in the country.

During the pandemic, the government reduced the repo rates to encourage banks to go ahead

and borrow funds thus pumping funds of about Rs 3.74 lakh crore into the system. Due to the

lockdown, there was a reduction in economic activities: people stopped buying goods,

manufacturing and construction came to halt. This stopped cash flow across the sectors. Banks

did not have guarantees to give out loans that could not be repaid and thus salaries could not

be paid. To mitigate this pressure several liquidity measures were adopted like CRR was

reduced, long-term repo and marginal standing facilities etc,.

Due to the lockdown, there was a reduction in economic activities: people stopped buying

goods, manufacturing and construction came to halt. Banks did not have guarantees to give out

loans that could not be repaid and thus salaries could not be paid. This stopped cash flow

across the sectors. To mitigate this pressure several liquidity measures were adopted like CRR

was reduced, long-term repo and marginal standing facilities etc,.

The RBI had allowed banks to give relief to borrowers by way of a three-month moratorium(EMI

holiday) on loan repayments. This was extended to six months in May. They are now petitioning

for a waiver of the interest that would accumulate during that time. However, doing this makes

banks lose a large amount of interest that could affect their obligation to meet their depositors

Hence to sum it up

● Banks play an important role in driving the national economy. They channelise deposited

money to individuals who need funds in the form of loans. This investment generates

more income for the economy.

● The rate of economic growth is closely monitored by the central bank and money is

pushed in or sucked out of the system to keep it in balance at all times.

● Currency with public = currency in circulation – cash on hand with banks

● Rep rate is the interest paid by commercial banks to the RBI

● Reverse repo rate is the interest paid by RBI to commercial banks.

Did you like it?